PARSEH Petrochemical Company (PARSEH PC) has been established to make a VAM (Vinyl Acetate

Monomer) production plant with the capacity of 50’000 Tons/Year in the first phase.

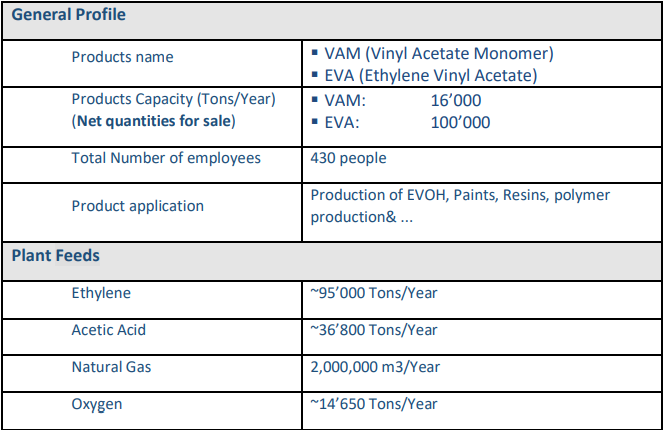

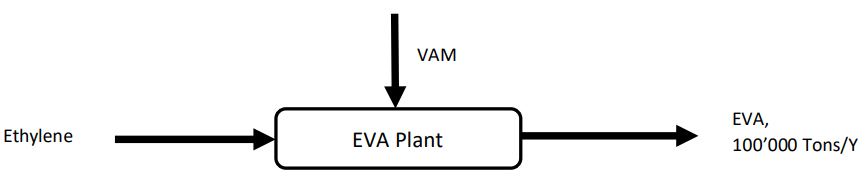

Afterward in the 2nd phase and based on the produced VAM it is planned to make an EVA (Ethylene

Vinyl Acetate) production plant with the capacity of 100’000 Tons/Year.

VAM introduction

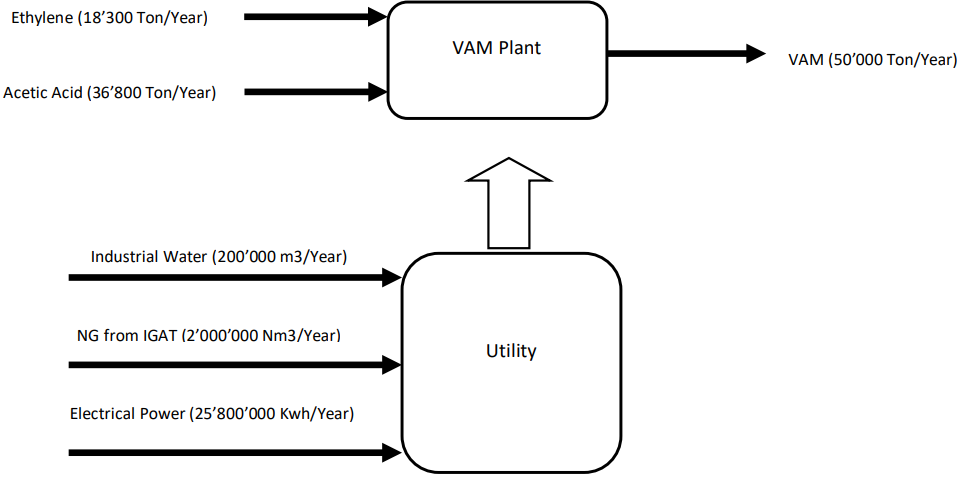

First Phase for PARSEH PC Project

The process contains Ethylene, Acetic Acid and Oxygen over a catalyst (i.e., Pd bed catalyst)

- Product name: VAM (Vinyl Acetate Monomer)

- Product capacity (tons/year) 50’000

- Number of employees 150 people

- “Feasibility Study” consultant Petrochemical Downstream Industries

Development Company

2.3Vinyl Acetate Monomer (VAM) Uses and Market Data

VAM is a liquid monomer which is used principally in the production other downstream

petrochemical substances such as EVA (Ethylene Vinyl Acetate), EVOH (Ethylene Vinyl Alcohol)

and also Polyvinyl Acetate.

The largest derivative is polyvinyl acetate (PVA) which is mainly used in adhesives as it has good

adhesion properties to a number of substrates including paper, wood, plastic films and metals.

Other uses for PVA include paper coatings, paints and industrial coatings.

The second largest consumer of VAM is polyvinyl alcohol (PVOH) which is manufactured from

PVA. Main uses for PVOH include textiles, adhesives, packaging films, thickeners and

photosensitive coatings.

VAM is consumed in the manufacture of ethylene vinyl acetate (EVA) and vinyl acetate ethylene

(VAE). EVA, which has less than 50% vinyl acetate in content, is mainly used for films and wire and

cable insulation. VAE, which contains more than 50% vinyl acetate, is primarily used as cement

additives, paints and adhesives.

A fast growing use of VAM is the manufacture of ethylene vinyl alcohol (EVOH) which is used as a

barrier resin in food packaging, plastic bottles and gasoline tanks, and in engineering polymers.

It is estimated that approximately 80% of global VAM production is used to make PVA and PVOH,

with most of the remaining volume going to PVB, EVA copolymers and EVOH resins.

The following key point defines how VAM market is expected to growth substantially:

- Increasing use of photovoltaic cells is expected to drive EVA (Ethylene Vinyl Acetate) demand

which in turn is expected to have a positive impact on the global VAM market. VAM demand

from EVA was valued USD 485.9 million in 2013. - EVOH (Ethylene Vinyl Alcohol) is expected to register the highest growth rate over the

forecast period owing to its increasing demand in packaging, polymer production and plastic

bottling applications. VAM demand for EVOH is expected to grow at an estimated CAGR

(Compound Annual Growth Rate) of 5.1% from 2014 to 2020. - Asia Pacific was the largest consuming region and accounted for 47.1% of the total market

volume in 2013. Increasing construction spending coupled with growing automotive

production in emerging markets of China and India is expected to drive the regional market.

Asia Pacific is also expected to witness the highest growth rate over the next five years. The

region is expected to grow at an estimated CAGR of 4.7% from 2014 to 2020.

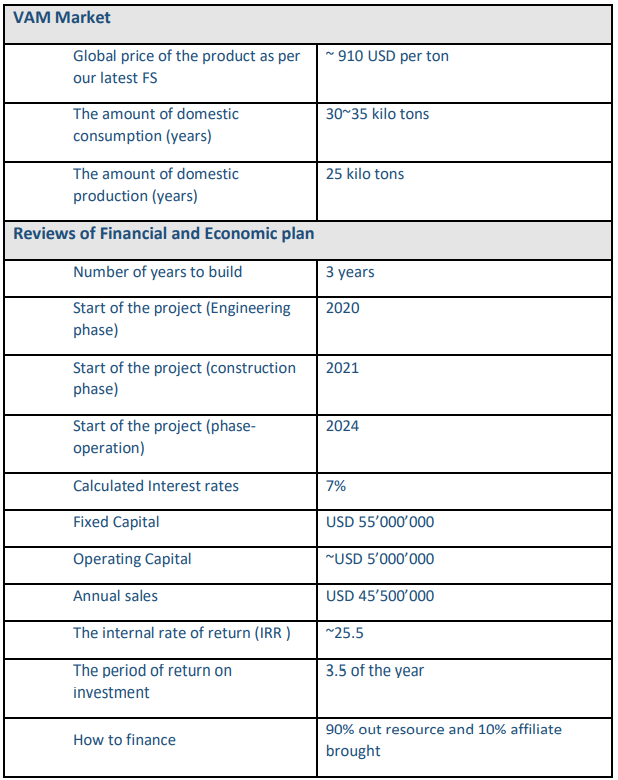

2.4PARSEH PC VAM Project Commercial Term in Brief

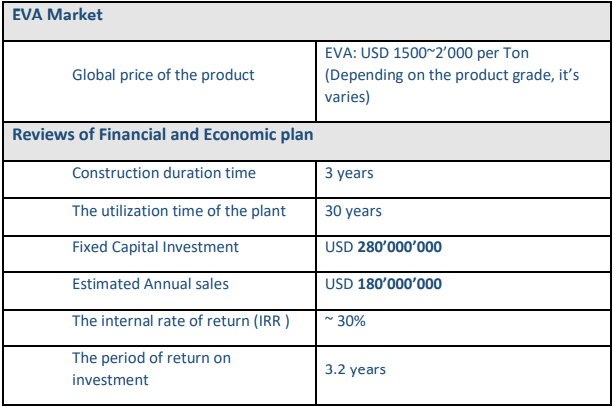

Second Phase for PARSEH PC Project

As a brief, the global EVA market projected to be worth up to USD 9.71 Billion by 2020,

registering a CAGR of 3.5% between 2015 and 2020. Off course, the market for EVA has been

categorized based on type, application, end-use industry and region, and it includes forecasts for

market size growth and analysis of trends in each of the submarkets.

PARSEH PC Project Status

At this moment, the following accomplishment has been completed:

− “Feasibility Study” for VAM; performed by well-known/ trustable company

− Purchasing more than 50 Hectare land, located in strategic area with multiple advantages and near to Gachsaran Ethylene plant

− Establishment license from Ministry of Industry and Mining

− Getting the Ethylene Feed permits for first phase

− Getting the Utility permits (NG, Water and Electrical Power)

− Getting Environmental permits

− Obtaining governmental and provincial permissions

− Financing arrangement now is under progress. It is expected to be finalized at 2021

The Land is being prepared and grant of Licenses is in progress.